Business Insurance in and around Centennial

Centennial! Look no further for small business insurance.

Cover all the bases for your small business

Insure The Business You've Built.

Running a small business requires much from you. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, trades, contractors and more!

Centennial! Look no further for small business insurance.

Cover all the bases for your small business

Protect Your Business With State Farm

Your business thrives off your creativity tenacity, and having reliable coverage with State Farm. While you make decisions for the future of your business and do what you love, let State Farm do their part in supporting you with commercial auto policies, business owners policies and worker’s compensation.

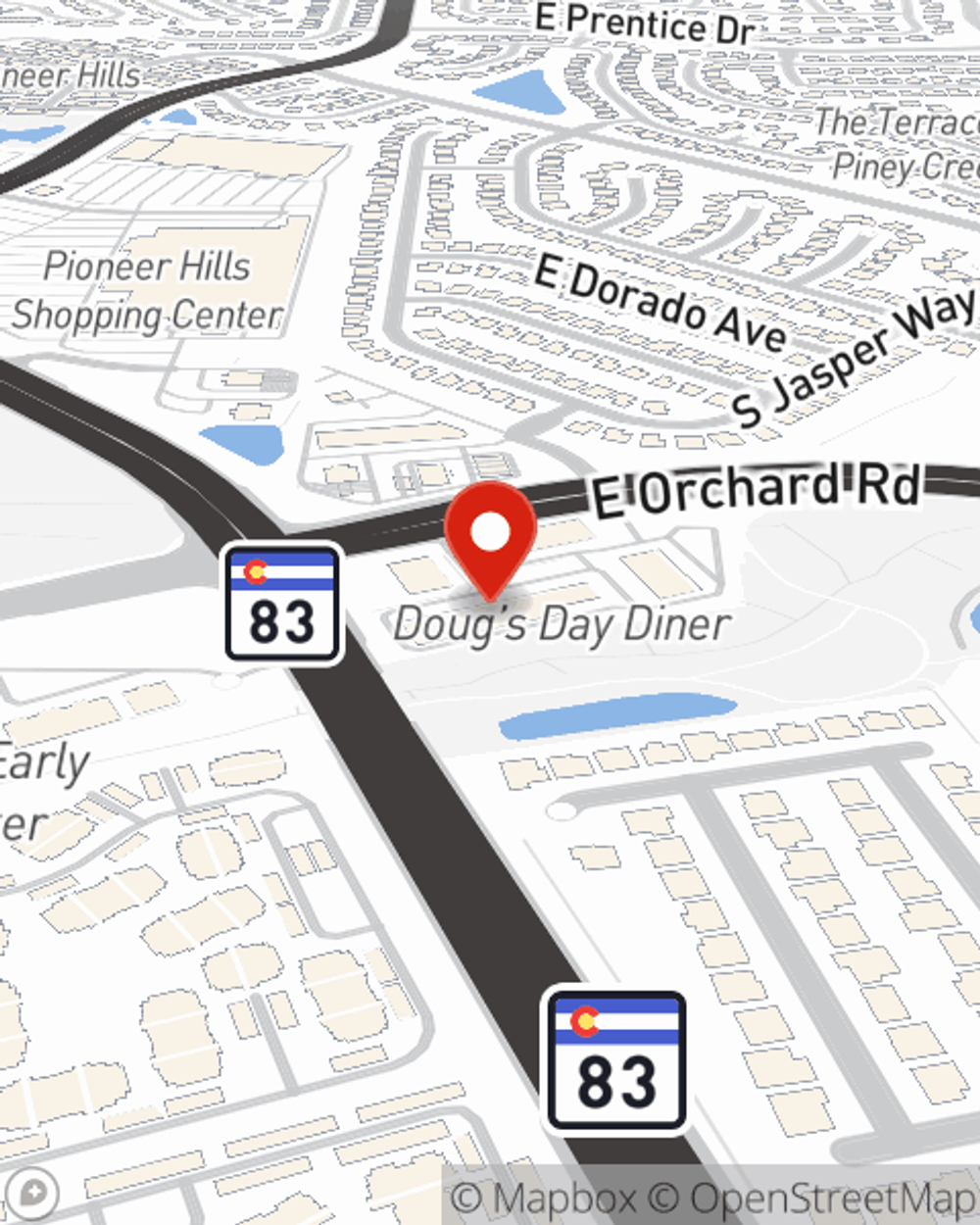

Let's chat about business! Call Scott Underwood today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Scott Underwood

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.